|

|

MONDAY / 04 SEPTEMBER 2017

|

IN FOCUS: Decentralization Reforms

The Philippines has

a long tradition of centralized governance. Since the Spanish period,

Manila has served as the seat of economic and political power, which

some claim became the main driver of the uneven development in the

country today. Through the passage of the Local Government Code (LGC)

in 1991, certain powers were devolved to local governments, which gave

them political, administrative, and fiscal autonomy.

However, the impacts of

decentralization have been mixed. Inequality in the country has

remained high relative to its East Asian neighbors, and the poverty

profile has barely changed over the past two decades. Poverty has

remained highly concentrated in the rural areas, particularly in

Mindanao. Effective decentralization has not been realized, analysts

noted, because devolved functions were not complemented by adequate

revenue-raising powers, clear division of responsibilities, and

bureaucratic capacity building. Thus, local governments continued to

face various challenges in the exercise of their devolved service

delivery functions.

The expenditure

assignment and spending distribution play a crucial part in it,

according to Philippine Institute for Development Studies (PIDS)

fiscal policy expert and Senior Research Fellow Rosario Manasan. The

national government transferred many of its unfunded mandates to local

government units (LGUs) leaving the latter unequipped with the

necessary appropriations to carry out their additional

responsibilities. As a result, some LGUs are struggling to sustainably

finance their basic services, such as health and education, according

to PIDS researchers Allan Layug, Ida Pantig, Leilani Bolong, and

Rouselle Lavado. Uma Keleker and Gilberto Llanto, PIDS consultant and

president, respectively, also discovered in their study that many LGUs

are not even capable of providing the mandated benefits for their

health workers under the Magna Carta for Public Health Workers.

Productive sources of

revenues could have helped the LGUs finance their basic services.

However, the LGC itself contributes to the low tax performance of LGUs,

as it fails to empower them with greater discretion in raising the

maximum allowable tax rates, according to Manasan. Llanto, in another

study, claimed this limitation significantly reduces local fiscal

autonomy and forces the LGUs to remain excessively dependent on the

internal revenue allotment to meet local budgetary needs.

The failure of the

government to prioritize capacity building also obstructs the country’s

goal to fully decentralize. In the basic education sector, alone, the Philippine Human Development Report 2008/2009 criticized

the institutional culture in the Department of Education (DepEd),

wherein lower offices rely on explicit instructions from higher office

before making decisions. The study tagged this top-bottom management

process as antithetical to the core values of decentralization. It urged

the DepEd to redefine the role of its central office, and empower and

capacitate its staff to be effective despite the limited resources at

their command.

The National Economic and Development Authority, in its Philippine Development Plan 2011-2016,

also noted the “confused and overlapping performance of functions” as a

factor behind the country’s failure to decentralize. In terms of

infrastructure, for instance, an article in the Philippine Journal of Development

published by PIDS found that the Department of Public Works and

Highways and other national agencies are still involved in the

construction of local roads, although with less budget and authority.

In terms of administration, Keleker and Llanto found that LGUs are

still complying with the guidelines of the Department of Budget and

Management on their employees’ salary, despite the autonomy the LGC has

granted them on this ground.

It is for these reasons

that PIDS dedicated the celebration of the 15th Development Policy

Research Month to the issue of decentralization reforms. With the theme

“Strengthening Decentralization for Regional Development”, the

Institute aims to highlight the need for in-depth reflections and evidence-based

analyses of decentralization reforms in the country, including the

shift to a federal form of government. For details on the 15th DPRM, go to https://dprm.pids.gov.ph/.

Know what other PIDS studies have to say about decentralization. Visit the Socioeconomic Research Portal for the Philippines. Simply type “decentralization”, “federalism”, and other related keywords in the search box.

|

September 5, 2017, 11-1PM

Press Conference on the 2017 DPRM (Theme: Strengthening Decentralization for Regional Development)

Venue: Philippine Information Agency, Quezon City

September 7, 2017, 9-5PM

Third Mindanao Policy Research Forum on Federalism as Policy Option for a Decentralized Inclusive Development

Venue: Ateneo De Zamboanga University, Zamboanga City

September 7, 2017, 12-1PM

Regional Press Conference on the 15th Development Policy Research Month (DPRM) Celebration

Venue: Ateneo De Zamboanga University, Zamboanga City

September 19, 2017, 9-5PM

Third Annual Public Policy Conference on Critical Perspectives on Federalism for Regional Development

Venue: Marco Polo Ortigas,

Pasig City

September 21, 2017, 9-5PM

PIDS-ERIA Public Symposium on Economic Integration and Nation Building

Venue: Marco Polo Ortigas,

Pasig City

October 18, 2017, 9-5PM

PIDS-ANU Forum on Regulation and Governance in the Philippines: Development Policy Challenges for the New Administration

Venue: Marco Polo Ortigas,

Pasig City

.jpg)

The Philippine Journal of Development

is a professional journal published by the Philippine Institute for

Development Studies. It accepts papers that examine key issues in

development and have strong relevance to policy development. As a

multidisciplinary social science journal, it accepts papers in the

fields of economics, political science, public administration,

sociology, and other related disciplines. It considers papers that have

strong policy implications on national or international concerns,

particularly development issues in the Asia-Pacific region.

CLICK HERE for the guidelines in the preparation of articles. Submissions and inquiries may be sent to PJD@mail.pids.gov.ph

|

|

|

POLICY NOTE

PN 2017-16: Preventing Childhood Stunting: Why and How?

by Alejandro N. Herrin

According

to the Food and Nutrition Research Institute, childhood stunting

affects one-third of under-five Filipino children annually.

Unfortunately, the Philippines has shown little progress in reducing its

prevalence in the last 20 years. This Policy Note analyzes

the factors contributing to child stunting in the country and finds

that mothers' nutrition and health status during pregnancy remain

crucial aspects that can influence birth outcomes. It asserts the need

to adopt a nutrition agenda focused on stunting prevention and the

effective delivery and financing of cost-effective interventions. It

also urges the Philippine government to take advantage of the existing

opportunities offered by the increasing global interest in child

stunting and the platforms for the identification of the poor and the

delivery and financing of health services. Click here for the full article.

DISCUSSION PAPERS

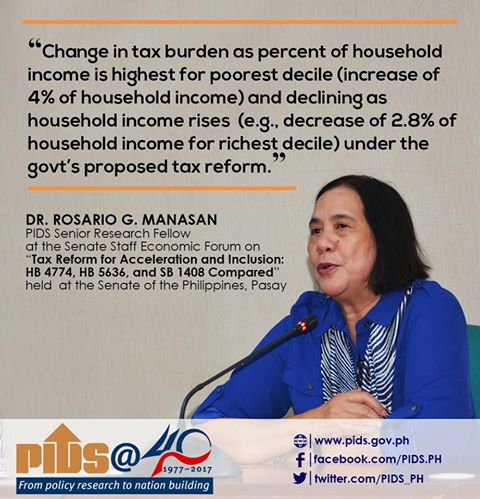

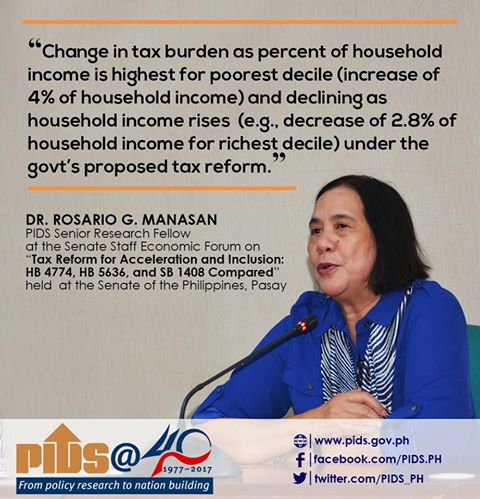

- DP 2017-27: Assessment of the 2017 Tax Reform for Acceleration and Inclusion

by Rosario G. Manasan

Despite

various reform efforts over the years, the Philippine tax system

continues to suffer from chronic weaknesses. The Duterte administration

is pursuing a simpler, more efficient, and more equitable system to

support its economic growth strategy. The administration's

Comprehensive Tax Reform Program (filed as House Bill No. 4774 and

Senate Bill No. 1408) and Tax Reform for Acceleration and Inclusion

(House Bill No. 5636) seek structural reform on personal income tax,

value-added tax, and excise tax on petroleum products and automobiles,

while improving the progressivity of the tax system. A portion of the

additional revenues generated will be earmarked for investments in

education, infrastructure, and health to stimulate long-term growth.

Look into the implications of these bills on the distribution of tax

burden across income groups, economic incentives in affected sectors,

national government revenues, as well as likely impact on tax

compliance in this paper. Click here for the full paper.

- DP 2017-26: Evaluation of Fiscal Incentives in the Philippines

by Danileen Kristel C. Parel

The

advantages of foreign direct investment to host countries,

particularly on economic growth, have long been recognized. The amount

of investment that enters a country is influenced by various factors,

including tax rates and the provision of fiscal incentives. This paper

(1) assesses how the Philippines fares in attracting investments

compared with its neighboring countries and (2) evaluates pending

incentive reforms in the country. As the corporate income tax does not

take into account other tax rules, effective tax rates, which provide a

single measure reflecting the combined effect of all tax rates and

incentives, were computed and used in the assessment.

Click here for the full paper.

|

|

Gov’t should approve new tax measure as package to be effective – PIDS research fellow Gov’t should approve new tax measure as package to be effective – PIDS research fellow

It is important to pass the new tax

reform bill of the government as a package, according to a senior

research fellow of the Philippine Institute for Development Studies.

This is not to say, however, that some of the components of the package

should not be reviewed further.

Dr. Rosario Manasan, an expert in public

finance, explained that approving and implementing the TRAIN (Tax

Reform for Acceleration and Inclusion) in a package increases the

likelihood that it will bring in more revenues for the government.

The TRAIN bill is part of the Department

of Finance’s Comprehensive Tax Reform Program that recommends the

lowering of personal income tax but increasing excise taxes on fuel, new

cars, and sugar products to offset possible losses. READ MORE

|

Childhood stunting in PH is prevalent – PIDS study Childhood stunting in PH is prevalent – PIDS study

One in every two children under five years

of age suffer from stunting, or those whose height is short for their

age, reveals a study of state think tank Philippine Institute for

Development Studies (PIDS).

PIDS consultant Alejandro Herrin in a policy

note titled “Preventing Childhood Stunting: Why and How?” disclosed that

the Philippines has shown little progress in reducing the prevalence of

childhood stunting in the last 20 years, despite its lasting

consequences on one’s health, learning, and economic productivity. READ MORE |

Need help? Have feedback? Feel free to contact us.

If you do not want to receive PIDS Updates, click here.

© 2017 Philippine Institute for Development Studies.

|

|

.jpg)

Gov’t should approve new tax measure as package to be effective – PIDS research fellow

Gov’t should approve new tax measure as package to be effective – PIDS research fellow Childhood stunting in PH is prevalent – PIDS study

Childhood stunting in PH is prevalent – PIDS study